Manna Capital Development Fund

Opportunity for real estate and development investments focused on lot development, institutionalized STR, build-to-rent, and self-storage throughout the Southeastern states.

We offer investors the opportunity to participate as limited partners while earning like general partners. We do this by sharing acquisition fees, project management fees, and cash flow with our investors.

16% Targeted Annual Return for at least $100,000 investment (Class C1)

18% Targeted Annual Return for at least $250,000 investment (Class C2)

100% Redemption as early as year 4 as projects complete and recapitalized into fund

8% Preferred Return

K1 Paper Losses 18-24% projected

Our Projects

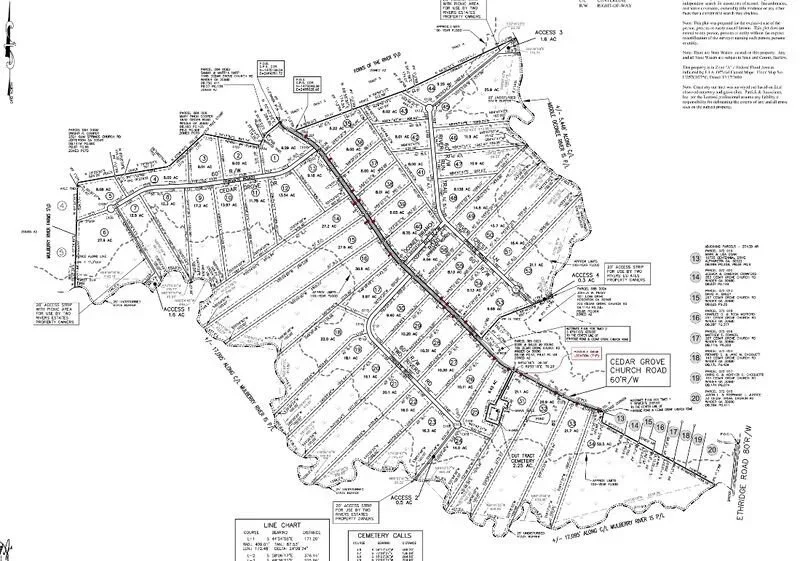

Haselton - Phase I

Gainesville, Georgia | Lot Development

Haselton Phase I in Gainesville, Georgia, is an 80-lot delivery project focused on entitlement and lot delivery rather than homebuilding. The business plan is to secure all necessary permits and sell the fully entitled lots to a homebuilder for vertical development. This is part of our Build-to-Rent allocation, which makes up 70% of the fund.

Aerial View of Undeveloped Property (2022)

Site Clearing in Progress as Entitlement Process Begins (2023)

Clearing Nearing Completion as Entitlement Process Continues (2024)

-

Fund Level

IRR: 45.3%

Equity Multiple: 1.65x

Project Level

IRR:

Equity Multiple:

-

This project follows our lot delivery strategy, where we focus on entitlement rather than homebuilding. By handling the entitlement process in-house, we remove a significant challenge for builders and position the lots to be sold at a premium.

Located on Lake Lanier, the site benefits from strong regional housing demand and Gainesville’s continued population growth, making it an attractive opportunity for homebuilders.

-

Last month, the final city approval on the land disturbance permit and civil plans was received. We are now evaluating exit strategies, including a potential sale as paper lots. Haselton Phase 1 highlights the flexibility of Build-to-Rent, supporting our fund strategy.

-

Last quarter, we worked with the city on permitting, addressing multiple rounds of comments. While the process took longer than expected, it allowed us to reassess exit options, including a paper-lot sale, highlighting the flexibility of Build-to-Rent.

-

Last month, we addressed the city’s final comments on Phase 1A permitting and received full approval. With the permit now secured, we are engaging buyers and moving quickly toward executing a letter of intent and closing on the sale of the Haselton lots.

-

Last quarter, we addressed final comments on the Phase 1 permit. This month, we advanced buyer selection and are now awaiting the LOI. Once both permit approval and LOI are secured, we will execute the contract and sell the Haselton lots.

-

In Q1 2025, we addressed final city comments and received permitting approval for Phase 1B of Haselton. Last quarter, we responded to additional Phase 1A comments. Upon securing Phase 1A approval, we will finalize the LOI and proceed to closing.

-

April 2025, we received city comments on Phase 1A. May, we addressed the comments and pivoted on the LOI. June, we await final permitting approval while advancing the LOI. Next: upon permit issuance, select a buyer and proceed with lot sales for Haselton.

-

Q1 2025, we received final permitting for Phase 1B and resubmitted Phase 1A. April, we received city comments on Phase 1A LDP. May, we responded and resubmitted for approval. Next steps: secure an LOI and move toward closing on Haselton.

-

In Q4 2024, we executed the purchase contract for all phases of Haselton Village and received permitting approval for Phase 1A. In Q1 2025, we secured full permitting for Phase 1B. Next steps: re-permit Phase 1A to current standards and move forward to closing.

-

We’ve received the LDP and civil plan approval for Haselton Phase 1B. We’re currently working through the city’s comments on LDPs for Phases 2 and 3. Once permits for all three phases are secured, we’ll finalize the sale of the project.

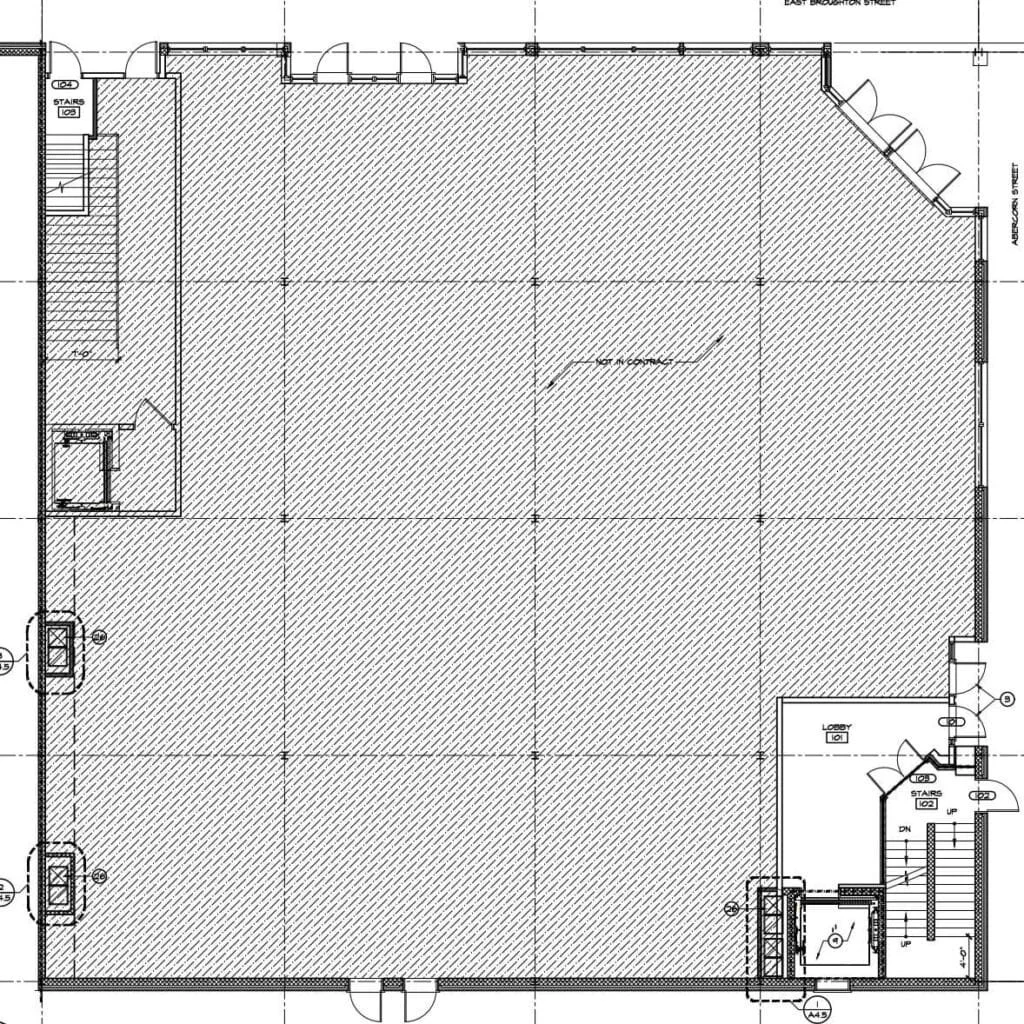

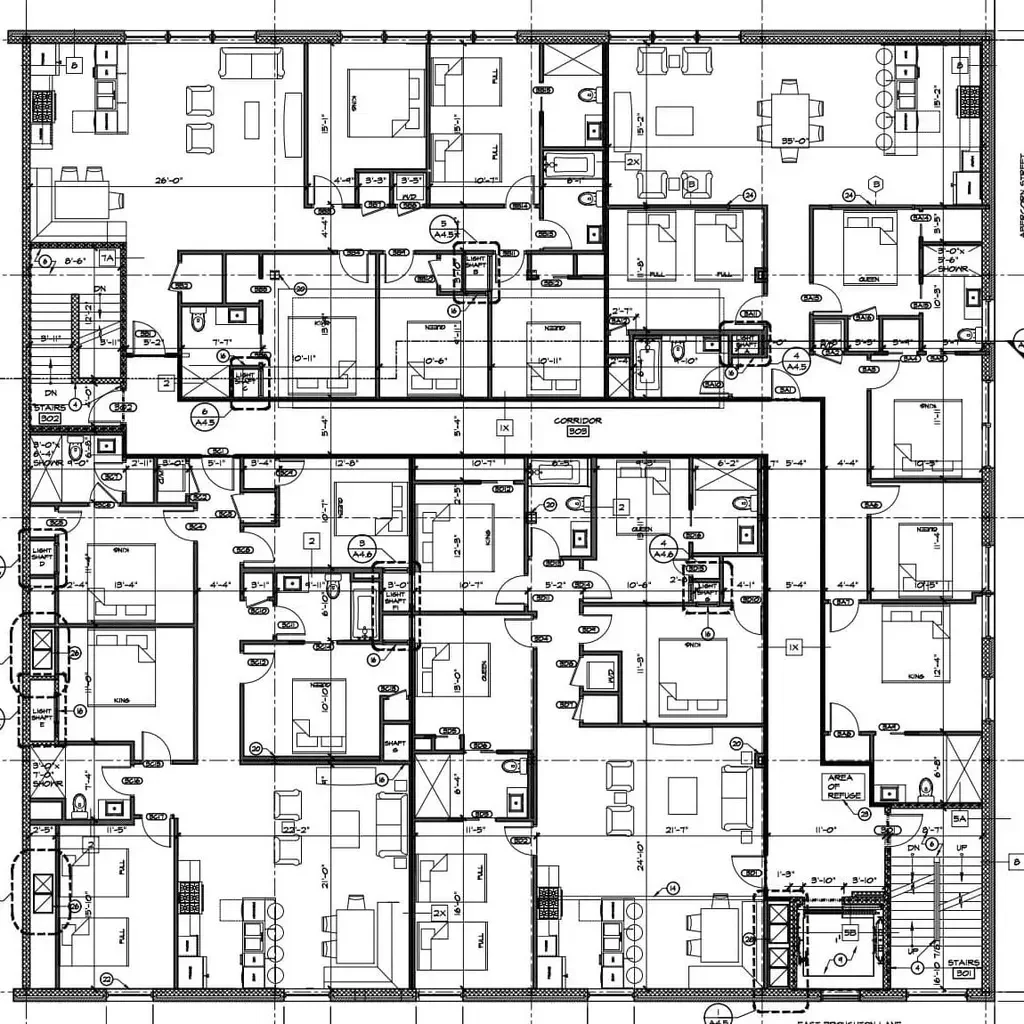

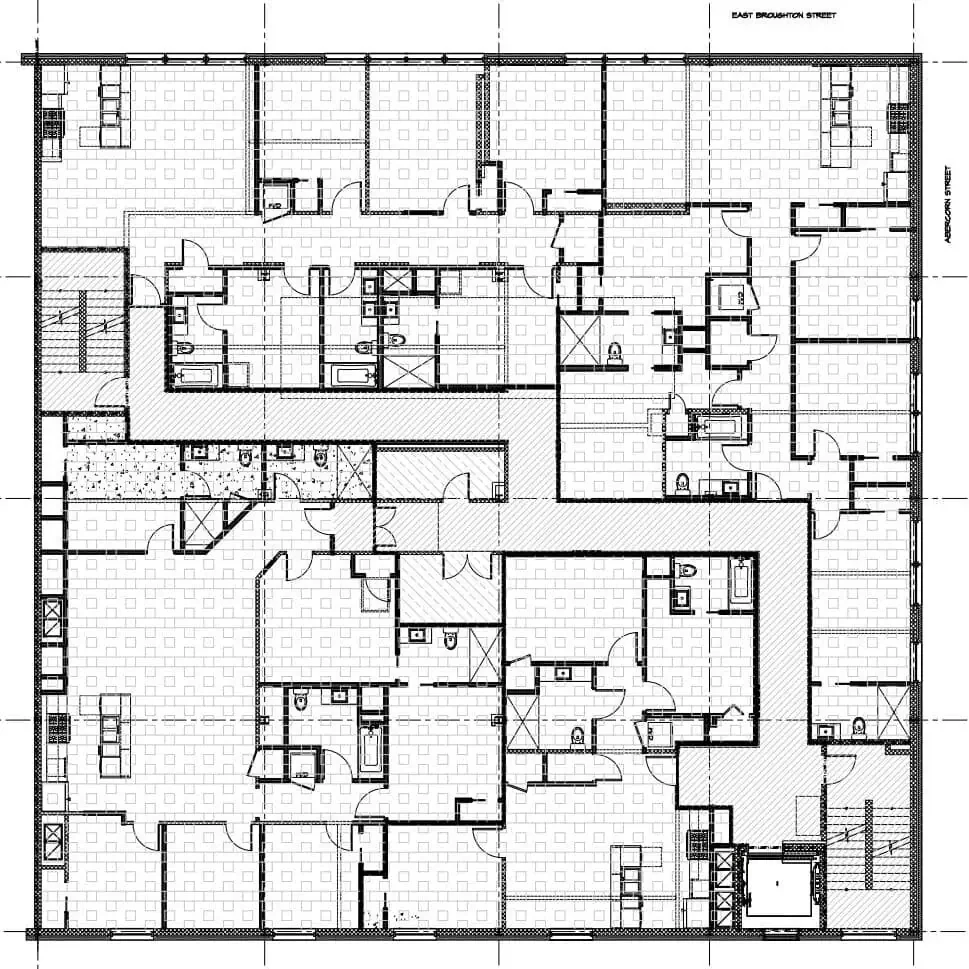

Broughton Street

Broughton Street is a historic building in downtown Savannah, Georgia, to be redeveloped into a boutique hotel with 8 luxury short-term rental units. The project includes a full renovation with upscale interiors and amenities, leveraging state and federal historic tax credits to enhance returns while preserving the property’s heritage. This is part of our short-term rental allocation, which makes up 12% of the fund.

Savannah, Georgia | Short-term Rental

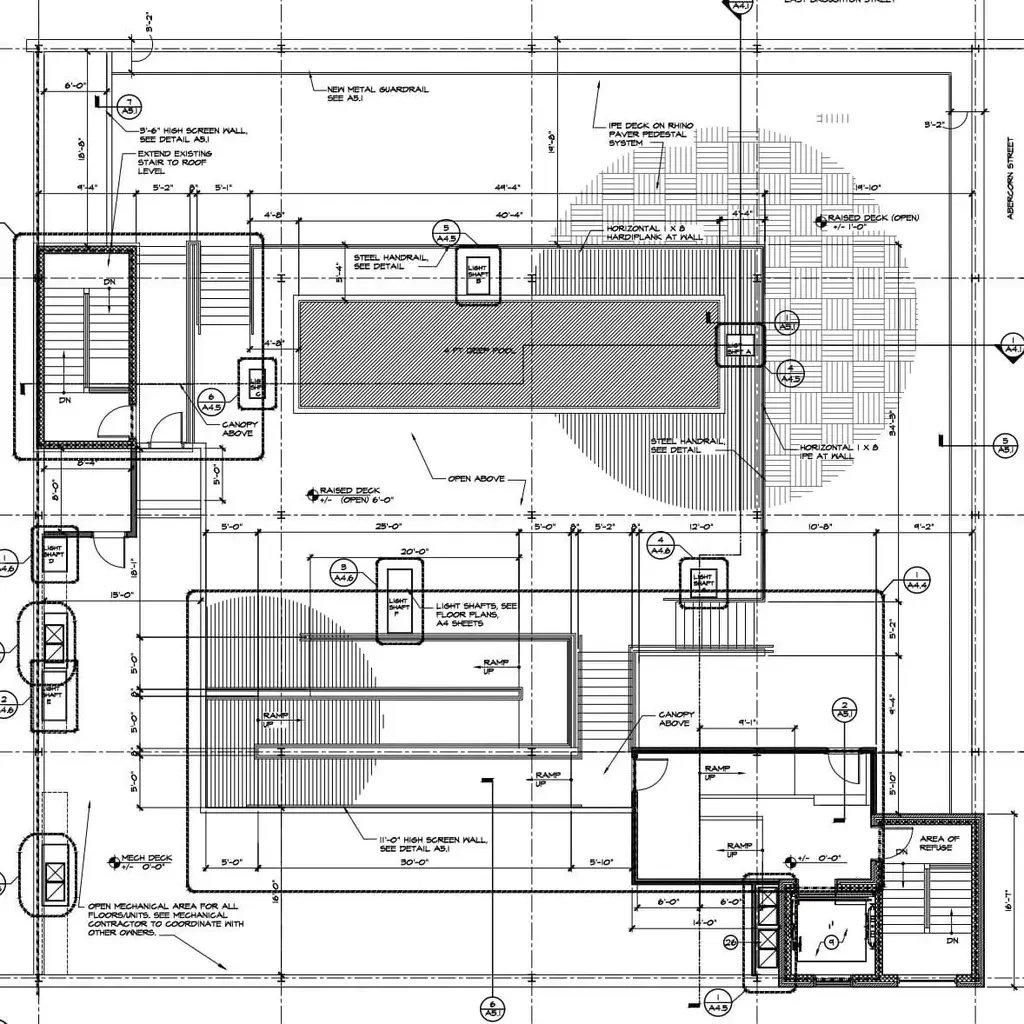

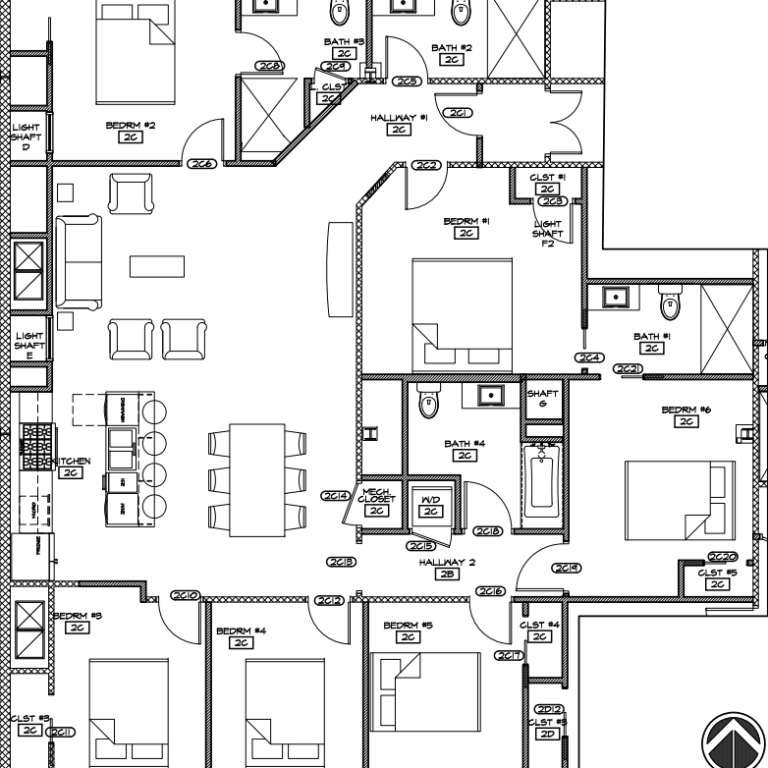

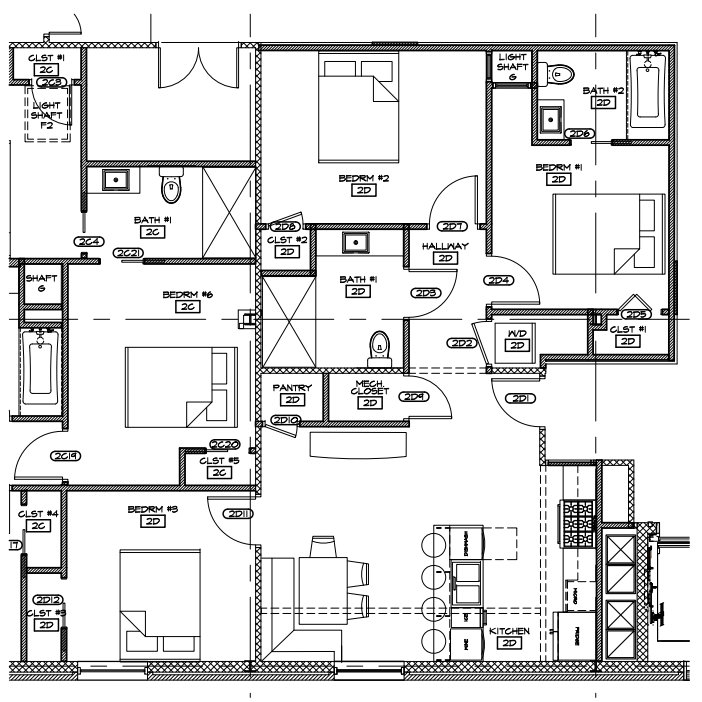

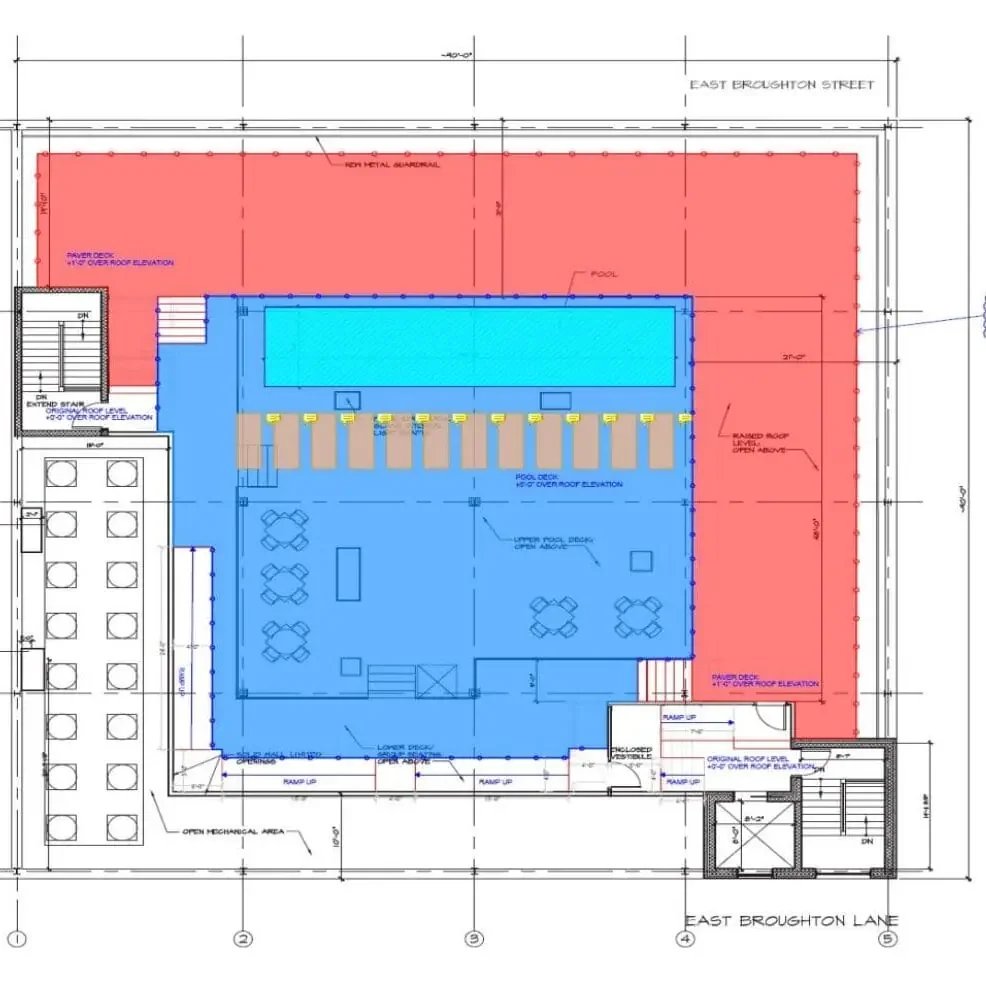

Preliminary Renovation Design Plans for First Floor, Second Floor, Third Floor, and Rooftop (May 2025)

Preliminary Renovation Design Plans Showcasing the Luxury Suite, Exterior, and Rooftop Pool (May 2025)

Existing Building on Broughton Street in Savannah (May 2025)

Rooftop Where Luxury Amenities Will Be Located (July 2025)

Third Level Cleared Out in Preparation for Renovation (July 2025)

Demolition Underway with Wooden Frames Removed (July 2025)

-

Fund Level

IRR: 81.3%

Equity Multiple: 10.71x

Project Level

IRR:

Equity Multiple:

-

The property will be transformed into a boutique hotel featuring 8 luxury short-term rental units, 40 bedrooms, and a rooftop pool.

Situated on Savannah’s iconic Broughton Street, the project is positioned to capture steady demand from one of the Southeast’s strongest year-round tourism markets.

-

We acquired the Broughton Street property in May with plans for a boutique hotel featuring eight luxury short-term rental units, 40 bedrooms, and a rooftop pool. Last month, demolition was completed, and design plans were submitted for a building permit.

-

Following our acquisition of our Broughton Street project on May 23, 2025, demolition is nearly complete. Design plans for layouts and interiors are being finalized, with permit submission next. Once approved, renovations will begin to convert the site into a boutique hotel.

-

On May 23, 2025, we acquired a historic building in Savannah, and demolition is currently underway as our team prepares for its redevelopment into a boutique hotel. We are in the process of securing building permits to commence renovations once the demolition is complete.

-

On May 23, 2025, we acquired an existing building on Broughton Street in downtown Savannah, Georgia. Demolition is currently underway as our team prepares to renovate the property into a boutique hotel featuring 8 short-term rentals, 40 bedrooms, and a rooftop pool.

-

We have completed our due diligence on an existing building in Savannah, Georgia, which we plan to renovate into a boutique hotel featuring 8 luxury short-term rentals, 40 bedrooms, and a rooftop pool. With this process concluded, we will proceed with acquiring the project.

-

We have placed a building under contract in downtown Savannah, Georgia, with plans to convert it into a boutique hotel featuring 8 luxury short-term rentals, 40 bedrooms, and a rooftop pool. We are currently conducting due diligence before adding this property to our fund.

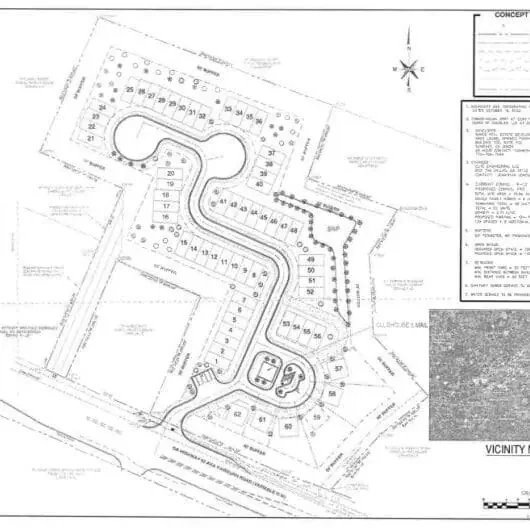

Gainesville Self-Storage

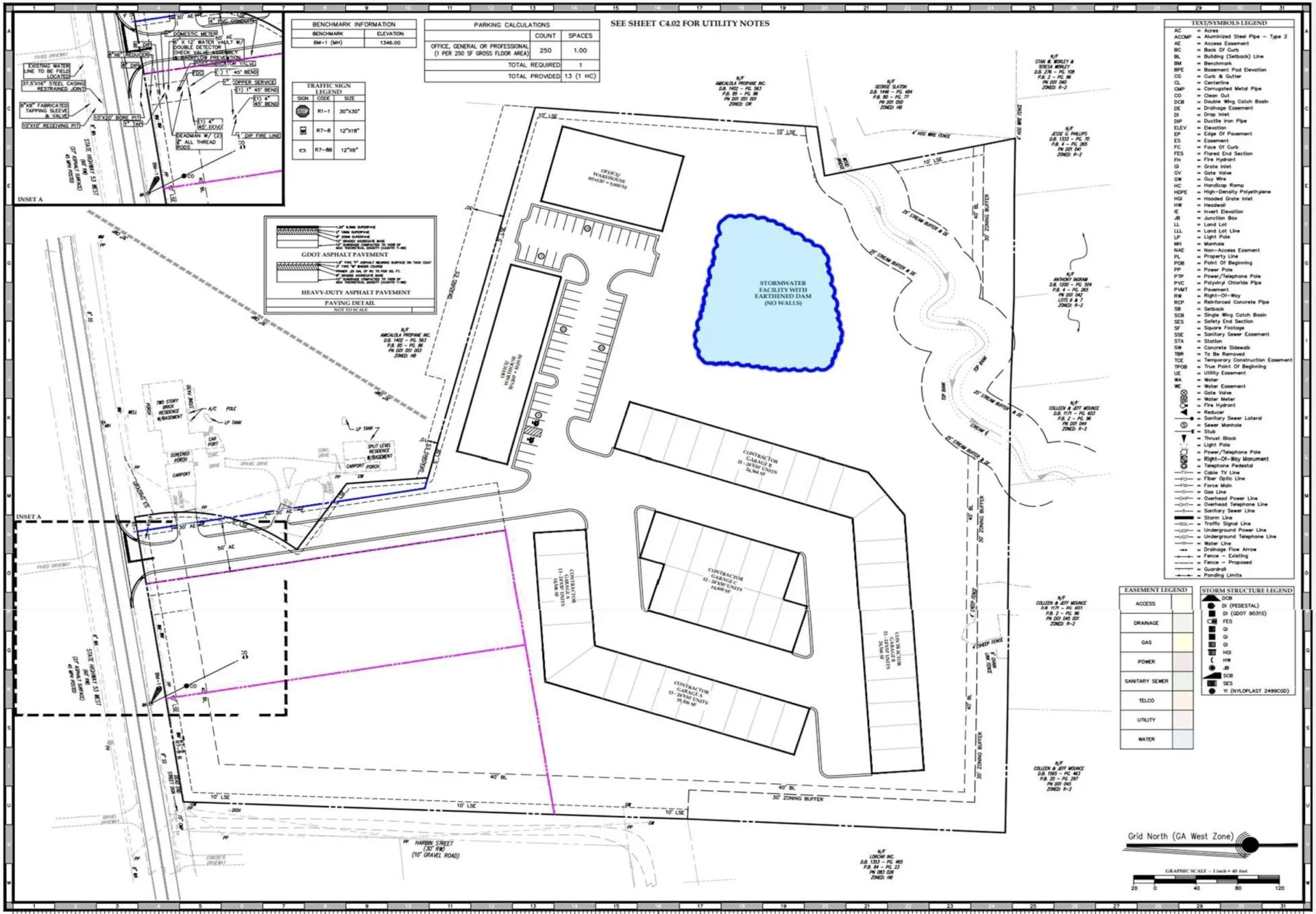

Gainesville Self-Storage is a planned three-story, 81,000-square-foot facility with about 600 climate-controlled units on 2.74 acres in Gainesville, Georgia. Designed to meet growing residential and commercial storage demand, the project offers secure, modern solutions in a resilient asset class that performs well across market cycles. This is part of our Self-Storage allocation which makes up 18% of the fund.

Gainesville, Georgia | Self-Storage

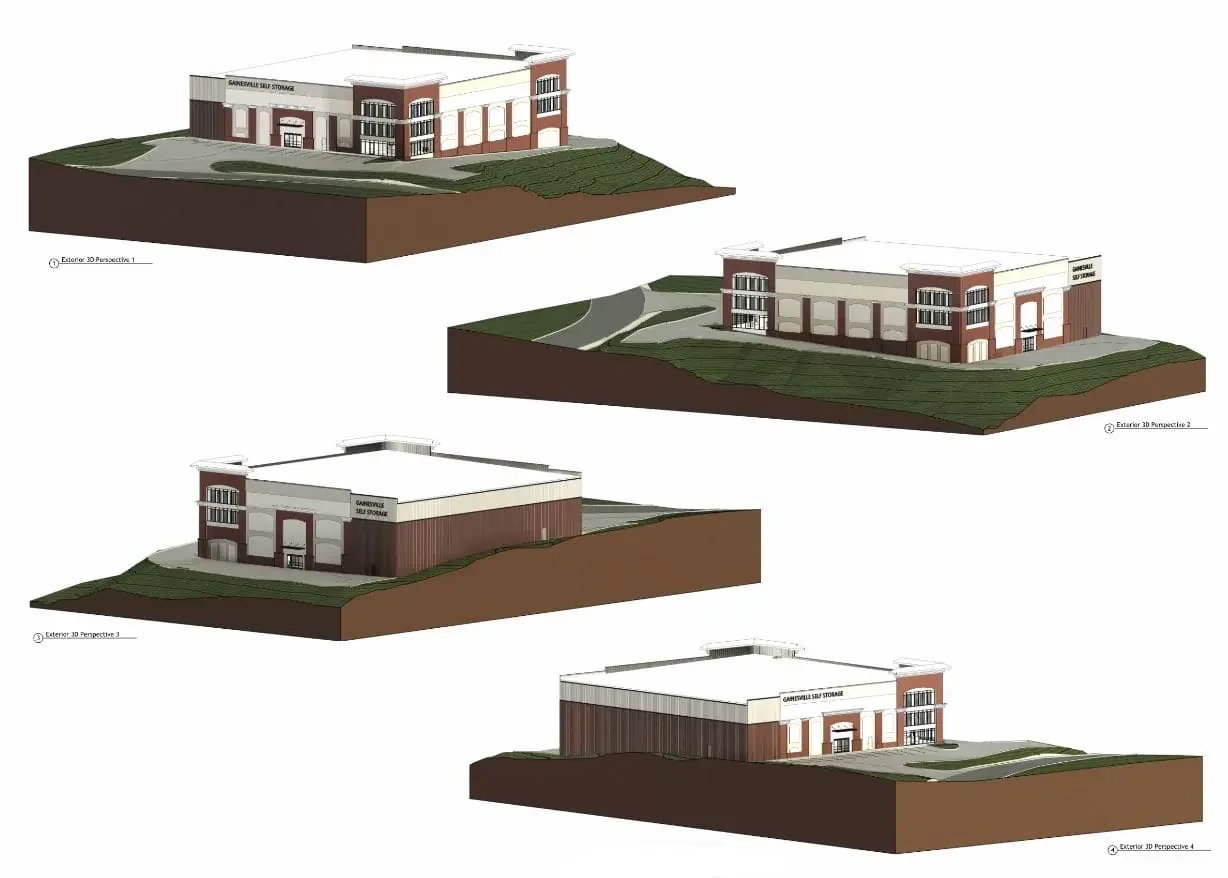

Additional Architectural Renderings of Three-Story Facility

Architectural Renderings of Three-Story Facility

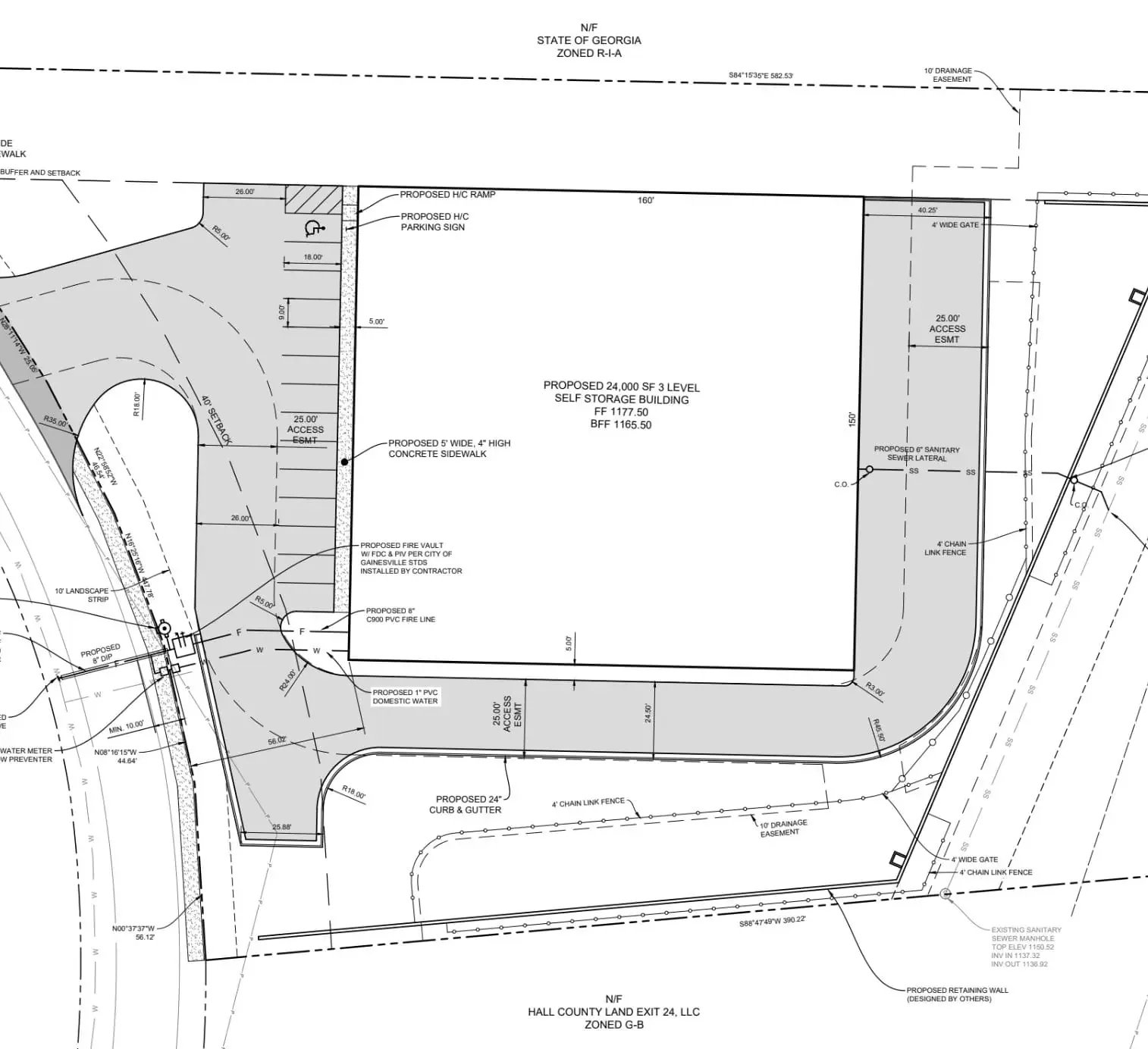

Proposed Site Plan

-

Fund Level

IRR: 47.74%

Equity Multiple: 6.72x

Project Level

IRR:

Equity Multiple:

-

The project is designed to serve a growing market with steady demand for both residential and commercial storage.

The development plan calls for a modern, climate-controlled building that provides secure, high-quality storage solutions for the community. Self-storage has proven to be a resilient asset class that performs well across market cycles, driven more by lifestyle trends than broader economic conditions.

As part of our Self-Storage allocation—which represents 18% of the fund—Gainesville Self-Storage will play an important role in generating consistent cash flow while balancing our Build-to-Rent and Short-Term Rental strategies.

-

In October, we officially broke ground and began horizontal development on this property. Since then, the site has been cleared and grading is underway, marking progress as we move through early development stages and prepare for future phases.

-

We officially began horizontal development on Gainesville Self-Storage. Site clearing is underway, with grading to follow. As development progresses, the project will generate fees that contribute income to the fund supporting quarterly distributions.

-

Last month, we completed our pre-construction meeting and submitted building design plans. This week we received approval and secured our building permit. With permitting done, we’re ready to begin horizontal development in the next few weeks.

-

In Q2 2025, we secured the site development permit and finalized plans for Gainesville Self-Storage. After a positive pre-construction meeting last week, our team is confident we’ll be able to break ground within the next month.

-

In Q1 2025, we completed due diligence and officially added this project to the Fund. We’ve secured the site development permit and finalized architectural plans, and are preparing to break ground soon. Estimated delivery: end of Q2 2026.

-

April 2025, we received civil and schematic design plans. May, we finalized architectural plans. June, we received final architectural drawings and are now selecting a general contractor. Next: secure building permit approval and begin horizontal development.

-

Q1 2025, we fully acquired Gainesville Self-Storage and received the site development permit. April, we obtained civil and schematic design plans. May, we are finalizing architectural plans and pursuing the building permit. Next: begin horizontal development.

-

In March, we submitted site plans for permitting; last week, we received the site development permit. Once we select the general contractor, landscaper, and signage architect, we’ll break ground and begin horizontal development.

-

In January, we added Gainesville Self-Storage to the Fund. Site plans were recently submitted; groundbreaking will follow once approved. This is one of four storage assets (15% of Fund allocation). We plan to add 2–3 more storage projects this year.

-

On January 16, we acquired a self-storage project in Gainesville, Georgia, for the Arabella Real Estate Fund. We are currently in pre-development, with architects and engineers finalizing vertical plans. We plan to break ground in Q2 2025.

Luxury Motor Condos

Luxury Motor Condos is a 10.5-acre specialty storage development in Dawsonville, Georgia, featuring 62 individual 1,200-square-foot car condos across 74,400 square feet. Each unit offers drive-up access and flexible space for car collectors, hobbyists, and entrepreneurs. This is part of our Self-Storage allocation which makes up 18% of the fund.

Dawsonville, Georgia | Self-Storage

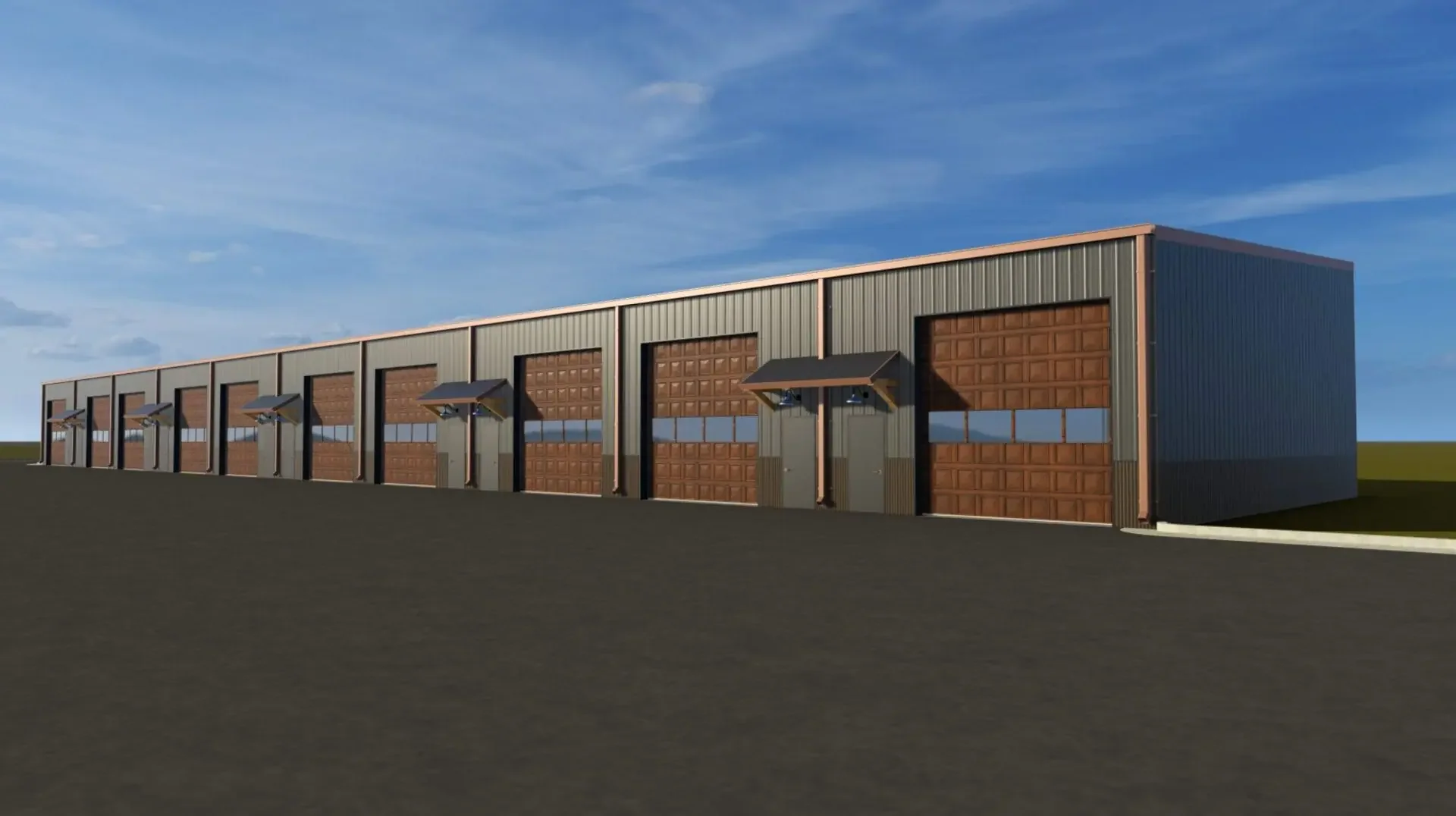

Conceptual Design Plans Featuring Motor Condo Rendering

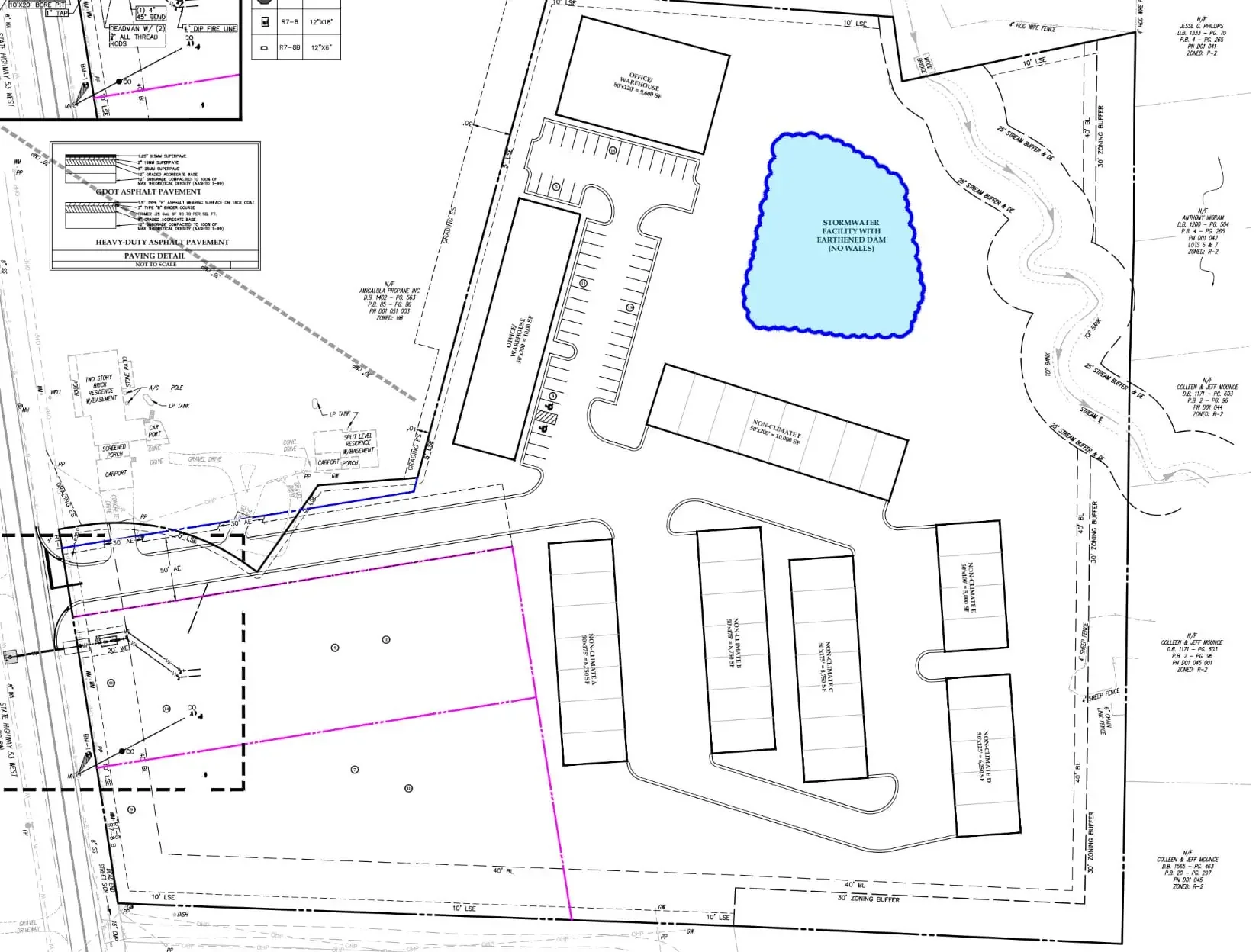

Site Plan of Multi-Building Motor Condo Facility

Each Unit Will Include a Drive-up Garage Door ana a Separate Personnel Entry

-

Fund Level

IRR: 30.02%

Equity Multiple: 2.18x

Project Level

IRR:

Equity Multiple:

-

Target Raised Amount: 2.5MM

The concept is designed for car collectors, hobbyists, off-road enthusiasts, and entrepreneurs seeking secure storage and workspace. More than just storage, the project fosters a sense of community among automobile and motorsports enthusiasts by providing high-quality, customizable spaces.

Strategically located near Atlanta Motorsports Park to the west and Iron Mountain Park to the north, the site is ideally positioned to attract both on-road and off-road enthusiasts. This combination of prime location, premium design, and specialized focus positions Luxury Motor Condos as a one-of-a-kind asset in the portfolio.

-

Our team is nearing completion of the full building design package. We plan to submit the design plans for a building permit once site work is complete. We are finalizing the land disturbance permit and will hold a pre-construction meeting upon approval.

-

Last quarter, we addressed several rounds of comments related to our land disturbance permit. While the process has taken longer than expected, our team is finalizing the permit. Once approved, we will hold a pre-construction meeting and prepare to break ground.

-

Last month, we addressed the city’s final comments on the land disturbance permit. We are now completing architectural, engineering, and structural plans. Once the permit is issued, we will submit the full design package and begin development.

-

Last quarter, we secured a general contractor and received conceptual design plans. This month, we addressed the city’s final permit comments. Once the permit is issued, we will submit the full building design package and begin development on the project.

-

In Q1 2025, we addressed city comments on our land disturbance permit. Last quarter, we worked toward approval, secured a general contractor, and received conceptual design plans. We expect approval soon and will break ground and begin development.

-

In Q1 2025, we addressed permit comments, received easements, and created conceptual photos. In April, we addressed another round of comments. We now await final approval. Next steps include selecting a partner and breaking ground.

-

In April, we addressed another round of comments on our land disturbance permit. Once approved, we will break ground and begin development. The project offers customizable garage and storage spaces for collectors, hobbyists, entrepreneurs.

-

We have submitted the plans and are awaiting the city’s approval to begin horizontal development. We also received conceptual renderings that illustrate what the Luxury Motor Condos will look like once completed, offering a clear preview of the finished project.

-

Last week, we received approval on plans submitted to the Georgia Department of Transportation. We are now working to obtain city approval for the land disturbance permit. Once approved, we plan to break ground in Q2 and advance the project into development.

-

After resubmitting our LDP in January, we addressed an additional round of city comments and expect full approval soon. Once approved, we will finalize the budget, select contractors, and break ground, moving the project into the next phase of development.

Steeple Chase

Steeplechase is a residential development in Hoschton, Georgia, consisting of 63 estate-sized lots within our Build-to-Rent allocation, which makes up 70% of the fund.

Hoschton, Georgia | Build-to-Rent

Undeveloped Land Ready for Development (October 2024)

Finished Home for Sale (October 2024)

Home Under Construction (October 2024)

Multiple Homes Nearing Completion (August 2025)

Home Nearing Completion (October 2025)

Completed Home for Sale (October 2025)

Completed Home for Sale (October 2025)

Completed Home for Sale (October 2025)

Steeplechase is a lot delivery project in Hoschton, Georgia, consisting of ~128 acres entitled for 63 estate-sized residential lots (0.5–1 acre each) within a gated community featuring a barn-style clubhouse, pool, ponds, and walking trails.

Our business plan is to deliver fully developed lots in three phases, sold as finished canvases to homebuilders for custom built homes, while potentially retaining a small number of lots for our own development to enhance returns for our fund.

This project follows our core lot delivery strategy, where we manage entitlement, horizontal development, and amenity installation in-house—eliminating major hurdles for builders and delivering premium pricing. Located in Jackson County—one of the top 10 fastest-growing counties in the U.S.—Steeplechase benefits from strong regional demand

-

Fund Level

IRR:

Equity Multiple:

Project Level

IRR:

Equity Multiple:

-

Following the April 24, 2025 sale of Phase 3 at Steeplechase for $2.03M, we retained four lots to manage risk and enhance returns. Last quarter, we added two more lots. We are finalizing home designs and financing for four lots and preparing the 2 lots for sale.

-

After selling Phase 3 of Steeplechase for $2.03 million, we retained four lots to mitigate risk and enhance fund returns. Last quarter, we added two more lots. Next steps include finalizing home plans for the four retained lots and selling the two additional lots.

-

On April 24, we closed the sale of Phase 3 of Steeple Chase for $2.03M, completing the disposition of the project. Originally planned as 18 lots, we retained 4 for vertical construction. Steeple Chase was acquired in 2021 and sold in three phases for $7.73M.

-

A year ago, we announced an executed contract to sell Steeplechase for $8.3M, projected to deliver a IRR of ~40%. Interested in participating in the returns from Steeplechase’s final closing? You still have time, invest indirectly through the Fund.

-

As many know, we sold Steeple Chase to a national homebuilder, with Phase 1 closing last March and Phase 2 in September. Development is moving quickly, with 10 homes completed and 6 under construction. Phase 3 is projected to close in March.

Baltimore Hill

Baltimore Hill is a 60.2-acre residential development in Huntsville, Alabama, planned for 182 finished lots. We will complete all horizontal development—grading, utilities, and roads—before selling the build-ready lots to two national homebuilders. This is part of our Build-to-Rent allocation, which makes up 70% of the fund.

Huntsville, Alabama | Build-to-Rent

Site Mobilization with Clearing Underway (July 2025)

Site Clearing and Grading Underway (July 2025)

Construction Vehicles Mobilizing for Site Grading (August 2025)

Site Mobilization and Grading Underway (August 2025)

Progressing Through Site Grading (August 2025)

Grading Nearing Completion (September 2025)

Final Touches Being Completed for Grading (September 2025)

Site Grading and Clearing Completed (September 2025)

Construction Equipment Used for Grading (September 2025)

Site After Grading Completed (September 2025)

Grading Completion (September 2025)

Preparing for Installation of Utilities (October 2025)

-

Fund Level

IRR: 86.10%

Equity Multiple: 2.55x

Project Level

IRR:

Equity Multiple:

-

Item description

We will complete the horizontal development—including grading, utilities, and roads—before selling the finished lots to 2 nationally recognized homebuilders for vertical construction.

This approach increases the project’s value by delivering finished, build-ready lots that remove entitlement and early-stage development risk for builders. For us, it creates stronger exit opportunities and positions the project to generate attractive returns for the fund.

Huntsville’s population growth and increased demand for housing makes Baltimore Hill a compelling addition to our Build-to-Rent allocation, strengthening our portfolio in one of the Southeast’s growing residential markets.

-

Last month, we began installing sewer and storm utilities at the site and have made significant progress, nearing completion. We are actively seeking a buyer so that once work is finished, we can sell the property as fully developed, finished lots

-

Last quarter, we broke ground, cleared the site, and began grading. This month, grading finished. Next, sewer and storm systems begin. As development advances, the project generates fund income via fees, shared with investors through quarterly distributions.

-

Last month, we officially broke ground and began clearing the property. We have since completed site clearing and begun grading the land. Grading is expected to be completed by early October, after which we will begin installing utilities.

-

Last quarter, we closed on the 60.2-acre Baltimore Hill in Huntsville, AL for $2,558,500 and secured permitting. Horizontal development is underway: site clearing in progress, followed by grading and utilities for the planned 182-lot community.

-

Last month, we completed due diligence and officially acquired Baltimore Hill for the Fund. We submitted plans, addressed city comments, and resubmitted for permitting. Last week, we began clearing and grading the site.

-

Earlier this week, we closed on Baltimore Hill — 60.2 acres in Huntsville, AL — for $2,558,500. The 182-lot community will be sold to two national homebuilders. Projected fund-level returns: 86.10% IRR, 2.55x equity multiple, 18-month hold.

-

On January 23, we placed Baltimore Hill under contract and began due diligence. In April, we submitted plans to the city for permitting. In May, we received comments and are now addressing them. Upon approval, we will finalize due diligence and close on the project.

-

One of our 2025 goals is adding four lot projects to the Fund; Baltimore Hill is one. Since going under contract, we’ve advanced due diligence, now verifying ownership and wetlands. We plan to close and add it to the Fund in Q3.

-

On January 23, we placed Baltimore Hill under contract. Last week, we submitted the Land Disturbance Permit application. Once approved, we will finalize due diligence and close, officially adding the 180-lot project to the Fund in Q3 2025.

-

Under Contract: Baltimore Hill – 60.2 acres in Huntsville, AL. On January 23, we placed the property under contract to develop 180 lots for sale to a national homebuilder. We are currently doing the due diligence needed to acquire and add this project to our fund.

Discovery Pointe

Discovery Pointe features 11 newly built townhomes in the Huntsville, Alabama area. Our plan is to sell these units as rental properties, aligning with our Build-to-Rent allocation, which represents 70% of the fund.

Huntsville, Alabama | Build-to-Rent

Rendering of Townhomes (October 2025)

Rendering of Townhomes (October 2025)

-

Fund Level

IRR:

Equity Multiple:

Project Level

IRR:

Equity Multiple:

-

Item description

This project consists of 11 newly built townhomes located in the greater Huntsville, Alabama area—one of the fastest-growing markets in the Southeast.

Our plan is to sell these units as rental properties, capitalizing on Huntsville’s strong rental demand and ongoing population growth.

-

On October 10, we acquired 11 completed townhomes in Huntsville for $2,184,200. Our plan is to sell a portion and retain remainder as rentals. The homes present well and are being prepared for market. This acquisition allowed reduced costs on another development.

-

On October 10th, we acquired a property in Huntsville, Alabama, comprising 11 townhomes with a purchase price of $2,184,200. Our business plan involves selling the townhomes as rental properties.

(New)Two Rivers Estates

Two Rivers Estates is a lot delivery project comprising 56 lots across 827 acres in Jackson County, Georgia, which is apart of our fund's Build-to-Rent allocation (70%).

Jackson County, Georgia | Build-to-Rent

This project will be designed for homesteading and will require minimal development.

Many will also have the option to operate entirely off-grid, creating a unique opportunity for buyers seeking privacy and self-sufficiency.

-

Fund Level

IRR:

Equity Multiple:

Project Level

IRR:

Equity Multiple:

-

Item description

-

On September 17, 2025, we acquired Two Rivers Estates in Jackson County, Georgia, a 56-lot homesteading project with minimal development. Preliminary plat is complete, and we plan to launch the community in the first half of 2026.

(New)Sweetwater Reserve

Sweetwater Reserve features 59 lots in Douglasville, Georgia, which we plan to develop into finished lots or a Build-to-Rent community. This project is apart of our Build-to-Rent allocation, which currently represents 70% of the fund.

Douglassville, Georgia | Build-to-Rent

Preliminary Site Plan (October 2025)

-

Fund Level

IRR:

Equity Multiple:

Project Level

IRR:

Equity Multiple:

-

Item description

This project will be serving the growing Atlanta metro population.

As both Fund Manager and Developer, we maintain control across every stage—from acquisition and entitlement to construction, leasing, and eventual sale—providing multiple exit strategies, enhanced risk mitigation, and the ability to capture value in any market environment.

-

On August 22, 2025, we placed a Douglasville, Georgia property under contract for $2,500,000. Due diligence began last month to ensure full development potential. Pending a smooth review, we plan to acquire the asset for the Fund.

-

On August 22, 2025, we placed a property in Douglasville, Georgia under contract for $2.5 million. We are completing zoning and permitting to confirm full development potential. Build-to-Rent anchors our Fund, supported by multiple exit strategies.

Heritage Village Phase 2 (Phase 1 Sold)

Heritage Village is a ±50-acre property located on Sanderson Road in Huntsville, Alabama, consisting of 114 lots within our Build-to-Rent allocation, which makes up 70% of the fund.

Huntsville, Alabama | Build-to-Rent

Site Grading in Preparation for Installation of Utilities (2023)

Installation of Properties Within Phase 1 (2024)

Roads Paved Within Phase 1 as Development Nears Completion (2025)

The business plan for this project is to horizontally develop the raw land into 114 finished residential lots and sell them directly to a national homebuilder.

The property benefits from Huntsville’s rapid population and job growth, making it an attractive location for builders seeking to deliver new housing to a growing market.

By taking projects through grading, infrastructure, and utilities, we solve a key problem for builders and capture value by selling build-ready lots at premium prices.

-

Fund Level

IRR:

Equity Multiple:

Project Level

IRR:

Equity Multiple:

-

Item description

-

Sold Phase 1 with 63 developed residential lots for $5,537,700

-

Last month, we went under contract to sell 63 lots in Heritage Phase 1 for $5,537,700. The buyer is currently completing due diligence, after which we expect to close the sale. Once Phase 1 is finalized, we will move forward with development of Phase 2.

-

Last quarter, we addressed city feedback on our plat submission, resubmitted it for approval, and began selecting a buyer. This month, we continued negotiations. After selling Phase 1, we will move forward with Phase 2 development.

-

Last month, we submitted the plat for approval and began the process of selecting a buyer. We are awaiting city feedback while continuing buyer discussions. Once a buyer is selected and the Phase 1 sale is finalized, we will begin development on Phase 2.

-

Last quarter, we completed the final base layer, paved roads, and finished landscaping. This month, we submitted the plat for approval and continued efforts to secure a buyer. Once the Phase 1 sale is finalized, development on Phase 2 will begin.

-

In Q1 2025, we completed installation of all utilities, curbs, and gutters. Last quarter, we installed the final base layer, paved roads, and completed landscaping and property dress-ups. We are now finalizing the plat submission and working toward securing an LOI.

-

In April 2025, we installed gutters and laid the initial base layer. In May, curbs were backfilled and the final base layer completed. In June, roads were paved, property dress-ups finalized, and the plat submitted. Next steps are to receive approval and pursue an LOI.

-

Heritage Village is a two-phase project within a single master-planned community. We are currently finalizing horizontal development for Phase 1. Once development is complete and the lots are sold, we will begin work on Phase 2

-

Last month, we completed utility installation, and last week we finished installing the curbs and gutters. Once curb backfilling and the final base layer are complete, we will begin paving the roads and continue progressing toward completion.

-

In January, electrical utilities were installed, followed by water line installation in February. In March, curbs are being installed, and pending favorable weather conditions, road paving will follow as the next step in advancing horizontal development.

-

Last week, we installed underground electrical utilities and are now working on water line installation. Once complete, we will begin curbs and gutters. This project is adjacent to Creekside Commons (54 lots), where horizontal development was completed last week.

Creekside Commons (Sold)

Creekside Commons is a lot delivery project in Huntsville, Alabama, consisting of 54 lots within our Build-to-Rent allocation, which represents 70% of the fund.

Huntsville, Alabama | Build-to-Rent

Site Grading in Preparation for Installation of Utilities (2024)

Installation of Underground Utilities (2024)

Roads Paving Finalized as Development Nears Completion (2025)

Creekside Commons is a 14-acre lot delivery project located on Sanderson Road in Huntsville, Alabama. Our plan is to horizontally develop the raw land into 54 finished residential lots and sell them directly to a national homebuilder.

The property benefits from Huntsville’s rapid population and job growth, making it an attractive location for builders seeking to deliver new housing to a growing market.

By taking projects through grading, infrastructure, and utilities, we solve a key problem for builders and capture value by selling build-ready lots at premium prices.

-

Fund Level

IRR: 71%

Equity Multiple: 1.75x

Project Level

IRR:

Equity Multiple:

-

Item description

-

54 developed residential lots, sold for $4,011,000

-

Last quarter, we finalized negotiations and went under contract for $4,011,000. Last month, we executed a contract for Heritage Village Phase 1, which will be sold alongside Creekside Commons. Once the buyer completes due diligence, we will finalize the sale of these lots.

-

Last quarter, we went under contract at $4,011,000. This month, the project is progressing toward closing. Once due diligence is complete, we will finalize the sale of this project, delivering realized returns to the Fund.

-

Last month, we finalized negotiations with the buyer and went under contract for $4,011,000. The buyer is now proceeding through due diligence to vet the property before closing. Once complete, we will finalize and execute the contract to sell these lots.

-

Last quarter, we received an LOI and began working through the details of a purchase and sale agreement. Last month, we finalized negotiations with the buyer and went under contract for $4,011,000. Once complete, we will execute the contract and finalize the sale.

-

In Q1 2025, we completed horizontal development and received plat approval, pivoting on an LOI received in October. Last quarter, we received a new LOI and advanced the PSA. Once finalized, we will exit the project, generating realized returns for the fund.

-

In April 2025, we received an LOI from a national homebuilder. In May and June, we continued working through the details of the purchase and sale agreement. Next steps are to execute the contract and complete the sale of these lots.

-

On March 28th, the city approved our final plat, and last week we received an LOI from a national homebuilder to purchase all 54 lots. We are currently working through the details of the purchase and sale agreement.

-

In March, we submitted the plat for approval. This week, we received and recorded the final plat.We are currently working to finalize a contract to sell the lots of Creekside Commons to a national homebuilder.

-

All horizontal development at Creekside Commons is complete, and the plat has been submitted for final city approval. Upon approval, we plan to sell all 54 developed lots to a national homebuilder, similar to our Steeplechase Phase 3 exit.

-

Horizontal development at Creekside Commons is complete, and we are preparing to submit the plat to the city for final approval. Once approved, we plan to sell all developed lots to a national homebuilder, positioning the project for an exit.