Real Estate Investment for the Alternative Investor

We offer accredited investors alternative real estate investment opportunities. Our current offerings include a private debt fund and a real estate development fund.

Manna Capital Group Founder's Note

When I started Manna Capital Group, I created what I wanted to invest in for ourselves; highly vetted, proven to perform assets in the most aggressive job growth areas of the United States.

We've purchased and corporately transacted in over $100,000,000, without ever losing investor principal.

As Fund Manager at Manna Capital Group, I lead Fund management, capital raises and oversee acquisitions and development. Over 15 years of experience investing in single family + multifamily, with active strategies across self-storage, institutional-grade short-term rentals, land development, build-to-rent, and strategic income fund/s.

We create extremely profitable returns, paying out millions of dollars in profit to our investors, while legally reducing millions of dollars of their tax liability.

Whether you are an institutional investor, family office or an accredited investor; it is our hope to earn your trust, add you to our short list, create life changing returns, and serve our communities.

Michael Krahn, Founder Manna Capital Group

Real Estate Investing Strategies

Manna Capital Group Fixed Income Mezzanine Opportunity for Accredited Investors

The Fund provides capital for short term loans to experienced builders and real estate investors. The Fund has experienced no realized principal losses since inception in 2019.

The Fund has made all scheduled investor distributions on time since inception.

Currently Performing at:

Monthly Distribution

10% Preferred Return for at least $100,000 investment (Class A1)

12% Preferred Return for at least $250,000 investment (Class A2)

13% Preferred Return for at least $1,000,000 investment on or March 31, 2026 (Class A3)

12 Months Minimum Lockup Period

Up to 25% Redemption of capital annually may be requested beginning after the initial 12-month hold period, subject to available liquidity and loan production.

Manna Capital Group Fixed Income Cash Flow Fund for Accredited Investors

The Fund purchases whole loans using warehouse line financing, and will blend that main strategy with short term debt securities to provide investors with more liquidity. Fund has experienced no realized principal losses since inception.

The Fund has made all scheduled investor distributions on time since inception.

Currently Performing at:

Monthly Distribution

9% Preferred Return for at least $100,000 investment (Class B1)

11% Preferred Return for at least $250,000 investment (Class B2)

12 Months Minimum Lockup Period

Up to 25% Redemption of capital annually may be requested beginning after the initial 12-month hold period, subject to available liquidity and loan production.

Manna Capital Group Development Opportunity for Accredited Investors

Opportunity for real estate and development investments focused on lot development, institutionalized STR, build-to-rent, and self-storage throughout the Southeastern states.

Currently Performing at:

16% Targeted Annual Return for at least $100,000 investment (Class C1)

18% Targeted Annual Return for at least $250,000 investment (Class C2)

8% Preferred Return

100% Redemption as early as year 4 as projects complete and recapitalized into fund

K1 Paper Losses 18-24% projected

Investment Metrics

$2+

Billion

Real Estate investments financed

1200+

Entrepreneurs

Real Estate investors and operators financed through their efforts

Manna Capital Group Development Fund

We offer investors the opportunity to participate as limited partners while earning like general partners. We do this by sharing acquisition fees, project management fees, and cash flow with our investors.

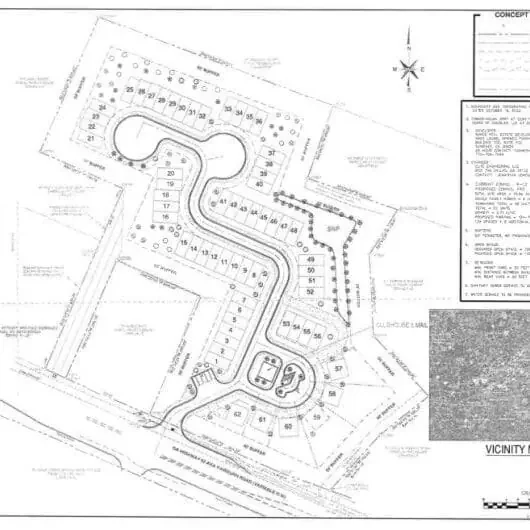

Haselton - Phase I

Gainesville, Georgia | Lot Development

Haselton Phase I in Gainesville, Georgia, is an 80-lot delivery project focused on entitlement and lot delivery rather than homebuilding. The business plan is to secure all necessary permits and sell the fully entitled lots to a homebuilder for vertical development. This is part of our Build-to-Rent allocation, which makes up 70% of the fund.

-

Projected Returns

IRR: 45.3%

Equity Multiple: 1.65x

-

IRR:

Equity Multiple:

-

Haselton Phase I is a lot delivery project in Gainesville, Georgia, consisting of 80 permitted residential lots. Our business plan is to fully entitle the property, securing all necessary permits before selling the lots to a homebuilder for vertical development.

This project follows our lot delivery strategy, where we focus on entitlement rather than homebuilding. By handling the entitlement process in-house, we remove a significant challenge for builders and position the lots to be sold at a premium.

Located on Lake Lanier, the site benefits from strong regional housing demand and Gainesville’s continued population growth, making it an attractive opportunity for homebuilders.

-

Broughton Street

Savannah, Georgia | Short-term Rental

Broughton Street is a historic building in downtown Savannah, Georgia, to be redeveloped into a boutique hotel with 8 luxury short-term rental units. The project includes a full renovation with upscale interiors and amenities, leveraging state and federal historic tax credits to enhance returns while preserving the property’s heritage. This is part of our short-term rental allocation, which makes up 12% of the fund.

-

Projected Returns

IRR: 81.3%

Equity Multiple: 10.71x

-

IRR:

Equity Multiple:

-

Broughton Street is an existing building we acquired, located in the heart of historic downtown Savannah, Georgia. The property will be transformed into a boutique hotel featuring 8 luxury short-term rental units, 40 bedrooms, and a rooftop pool.

The development plan calls for a complete renovation of the historic structure, incorporating high-end interiors and unique amenities. By pursuing both state and federal historic tax credits, we are able to enhance returns while preserving the building’s heritage.

Situated on Savannah’s iconic Broughton Street, the project is positioned to capture steady demand from one of the Southeast’s strongest year-round tourism markets.

-

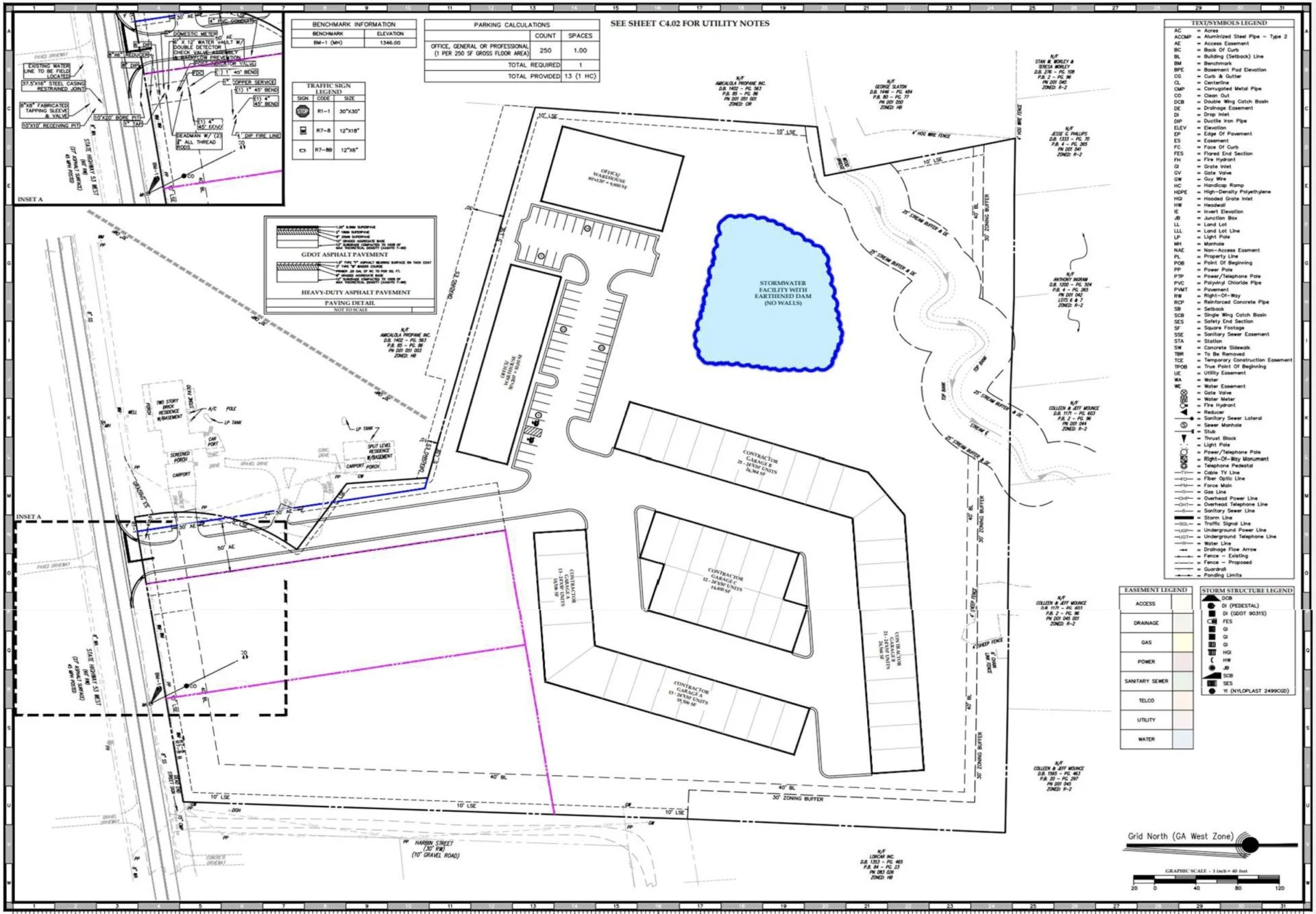

Gainesville Self-Storage

Gainesville, Georgia | Self-Storage

Gainesville Self-Storage is a planned three-story, 81,000-square-foot facility with about 600 climate-controlled units on 2.74 acres in Gainesville, Georgia. Designed to meet growing residential and commercial storage demand, the project offers secure, modern solutions in a resilient asset class that performs well across market cycles. This is part of our Self-Storage allocation which makes up 18% of the fund.

-

Projected Returns

IRR: 47.74%

Equity Multiple: 6.72x

-

IRR:

Equity Multiple:

-

Gainesville Self-Storage is a planned three-story facility totaling 81,000 square feet and offering approximately 600 storage units. Situated on 2.74 acres in Gainesville, Georgia, the project is designed to serve a growing market with steady demand for both residential and commercial storage.

The development plan calls for a modern, climate-controlled building that provides secure, high-quality storage solutions for the community. Self-storage has proven to be a resilient asset class that performs well across market cycles, driven more by lifestyle trends than broader economic conditions.

As part of our Self-Storage allocation—which represents 18% of the fund—Gainesville Self-Storage will play an important role in generating consistent cash flow while balancing our Build-to-Rent and Short-Term Rental strategies.

-

Baltimore Hill

Huntsville, Alabama | Build-to-Rent

Baltimore Hill is a 60.2-acre residential development in Huntsville, Alabama, planned for 182 finished lots. We will complete all horizontal development—grading, utilities, and roads—before selling the build-ready lots to two national homebuilders. This is part of our Build-to-Rent allocation, which makes up 70% of the fund.

-

Projected Returns

IRR: 86.10%

Equity Multiple: 2.55x

-

IRR:

Equity Multiple:

-

Baltimore Hill spans 60.2 acres in Huntsville, Alabama, and is planned for 182 residential lots, which we will sell as developed lots. This means we will complete the horizontal development—including grading, utilities, and roads—before selling the finished lots to 2 nationally recognized homebuilders for vertical construction.

This approach increases the project’s value by delivering finished, build-ready lots that remove entitlement and early-stage development risk for builders. For us, it creates stronger exit opportunities and positions the project to generate attractive returns for the fund.

Huntsville’s population growth and increased demand for housing makes Baltimore Hill a compelling addition to our Build-to-Rent allocation, strengthening our portfolio in one of the Southeast’s growing residential markets.

-

Luxury Motor Condos

Dawsonville, Georgia | Self Storage

Luxury Motor Condos is a 10.5-acre specialty storage development in Dawsonville, Georgia, featuring 62 individual 1,200-square-foot car condos across 74,400 square feet. Each unit offers drive-up access and flexible space for car collectors, hobbyists, and entrepreneurs. This is part of our Self-Storage allocation which makes up 18% of the fund.

-

Projected Returns

IRR: 30.02%

Equity Multiple: 2.18x

-

Projected Returns

IRR: 25.57%

Equity Multiple: 1.74x

-

Luxury Motor Condos is a unique storage development located on 10.5 acres along Georgia Highway 53 in Dawsonville, Georgia. The project will consist of 62 individual 1,200-square-foot car condos, spread across multiple buildings totaling 74,400 square feet. Each unit will feature a drive-up garage door and personnel entry, blending the functionality of a traditional garage with the flexibility of personal storage.

The concept is designed for car collectors, hobbyists, off-road enthusiasts, and entrepreneurs seeking secure storage and workspace. More than just storage, the project fosters a sense of community among automobile and motorsports enthusiasts by providing high-quality, customizable spaces.

Strategically located near Atlanta Motorsports Park to the west and Iron Mountain Park to the north, the site is ideally positioned to attract both on-road and off-road enthusiasts. This combination of prime location, premium design, and specialized focus positions Luxury Motor Condos as a one-of-a-kind asset in the portfolio.

-

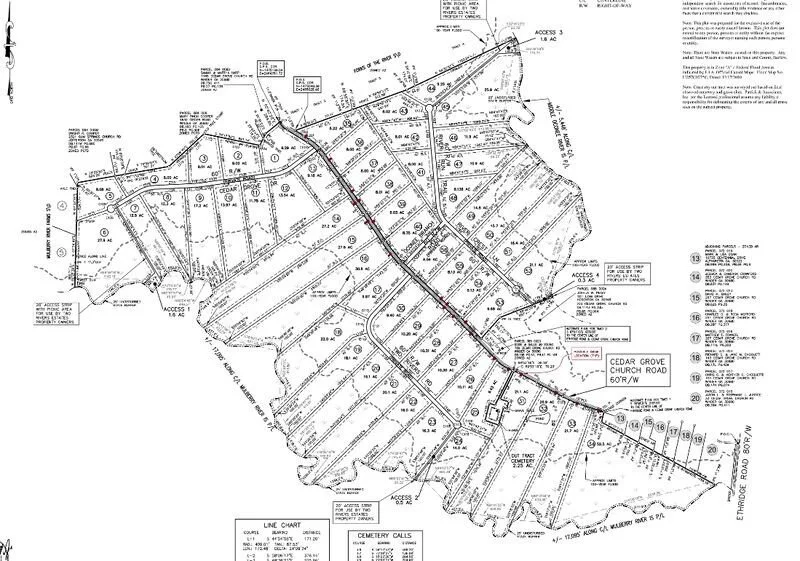

Steeple Chase

Hoschton, Georgia | Residential Development

Steeplechase is a residential development in Hoschton, Georgia, consisting of 63 estate-sized lots within our Build-to-Rent allocation, which makes up 70% of the fund.

-

Projected Returns

IRR:

Equity Multiple:

-

IRR:

Equity Multiple:

-

Steeplechase is a lot delivery project in Hoschton, Georgia, consisting of ~128 acres entitled for 64 estate-sized residential lots (0.5–1 acre each) within a gated community featuring a barn-style clubhouse, pool, ponds, and walking trails.

Our business plan is to deliver fully developed lots in three phases, sold as finished canvases to homebuilders for custom built homes, while potentially retaining a small number of lots for our own development to enhance returns for our fund.

This project follows our core lot delivery strategy, where we manage entitlement, horizontal development, and amenity installation in-house—eliminating major hurdles for builders and delivering premium pricing. Located in Jackson County—one of the top 10 fastest-growing counties in the U.S.—Steeplechase benefits from strong regional demand

-

Discovery Pointe

Huntsville, Alabama | Build-to-Rent

Discovery Pointe features 11 newly built townhomes in the Huntsville, Alabama area. Our plan is to sell these units as rental properties, aligning with our Build-to-Rent allocation, which represents 70% of the fund.

-

IRR:

Equity Multiple:

-

IRR:

Equity Multiple:

-

This project consists of 11 newly built townhomes located in the greater Huntsville, Alabama area—one of the fastest-growing markets in the Southeast.

Our plan is to sell these units as rental properties, capitalizing on Huntsville’s strong rental demand and ongoing population growth.

This project aligns with our Build-to-Rent allocation, which represents 70% of the Arabella Real Estate Fund, and continues our focus on investing in high-demand, high-growth markets.

-

(New) Two Rivers Estates

Jackson County, Georgia | Build-to-Rent

Two Rivers Estates is a lot delivery project comprising 56 lots across 827 acres in Jackson County, Georgia, which is apart of our fund's Build-to-Rent allocation (70%).

-

IRR:

Equity Multiple:

-

IRR:

Equity Multiple:

-

Two Rivers Estates is a lot delivery project comprising 56 lots across 827 acres in Jackson County, Georgia, which is apart of our Fund’s Build-to-Rent allocation (70%).

This project will be designed for homesteading and will require minimal development.

Many will also have the option to operate entirely off-grid, creating a unique opportunity for buyers seeking privacy and self-sufficiency.

-

(New) Sweetwater Reserve

Douglasville, Georgia | Build-to-Rent

Sweetwater Reserve features 59 lots in Douglasville, Georgia, which we plan to develop into finished lots or a Build-to-Rent community. This project is apart of our Build-to-Rent allocation, which currently represents 70% of the fund.

-

IRR:

Equity Multiple:

-

IRR:

Equity Multiple:

-

Sweetwater Reserve consists of 59 lots in Douglasville, Georgia, which we plan to develop as finished lots or a Build-to-Rent community serving the growing Atlanta metro population.

This project falls within our Build-to-Rent allocation, which remains the cornerstone of our Growth & Income Fund and represents 70% of the portfolio.

As both Fund Manager and Developer, we maintain control across every stage—from acquisition and entitlement to construction, leasing, and eventual sale—providing multiple exit strategies, enhanced risk mitigation, and the ability to capture value in any market environment.

-

Heritage Village Phase 1 & 2

Huntsville, Alabama | Build-to-Rent

Heritage Village is a lot delivery project in Huntsville, Alabama, consisting of 114 lots within our Build-to-Rent allocation, which makes up 70% of the fund. The business plan for this project is to horizontally develop the raw land into 114 finished residential lots and sell them directly to a national homebuilder.

-

IRR:

Equity Multiple:

-

IRR:

Equity Multiple:

-

Heritage Village is a ±50-acre property located on Sanderson Road in Huntsville, Alabama. The business plan for this project is to horizontally develop the raw land into 114 finished residential lots and sell them directly to a national homebuilder.

The property benefits from Huntsville’s rapid population and job growth, making it an attractive location for builders seeking to deliver new housing to a growing market.

By taking projects through grading, infrastructure, and utilities, we solve a key problem for builders and capture value by selling build-ready lots at premium prices.

-

Creekside Commons

Huntsville, Alabama | Build-to-Rent

-

IRR:

Equity Multiple:

-

-

Creekside Commons is a 14-acre lot delivery project located on Sanderson Road in Huntsville, Alabama. Our plan is to horizontally develop the raw land into 54 finished residential lots and sell them directly to a national homebuilder.

The property benefits from Huntsville’s rapid population and job growth, making it an attractive location for builders seeking to deliver new housing to a growing market.

By taking projects through grading, infrastructure, and utilities, we solve a key problem for builders and capture value by selling build-ready lots at premium prices.

Creekside Commons is a 14-acre lot delivery project located on Sanderson Road in Huntsville, Alabama within our Build-to-Rent allocation, which represents 70% of the fund. Our plan is to horizontally develop the raw land into 54 finished residential lots and sell them directly to a national homebuilder.

Manna Capital Group Income Fund Team

Michael K.

is responsible for property acquisitions, private equity raises and execution of business strategies. These companies actively invest in opportunistic multifamily, land development, self storage, software & fintech credit solutions nationwide with a focus in WA and GA. Michael's business and advisory experience adds value to investors providing them with undiscovered investment opportunities and multiple exit strategies. With over a decade of no principal losses, Manna Capital Group shows accredited investors how to aggressively reduce their tax liabilities while generating annual cash flow with large equity returns.

Charles M.

covers investment structuring and risk management. Charles has a 22-year career as an entrepreneur, real estate investor, and financial services executive. Charles is the CEO and cofounder of Vontive and Certain Lending, fast-growing mortgage-technology and Fintech lending businesses focused on real estate investors and backed by leading venture capital firms. Previously, Charles was senior vice president and head of analytics at Ten-X | Auction.com. From 2009 to 2014, Charles was one of the executives responsible for managing credit losses for Freddie Mac’s $1.4 trillion single-family mortgage portfolio, where he oversaw sales of >450,000 distressed properties to real estate investors.

In May 2025, Vontive announced a $150M revolving securitization and a strategic equity investment from Citi, expanding institutional access to real estate private credit. Source.

Manna Capital Group Development Fund Team

Michael K.

is responsible for property acquisitions, private equity raises and execution of business strategies. These companies actively invest in opportunistic multifamily, land development, self storage, software & fintech credit solutions nationwide with a focus in WA and GA. Michael's business and advisory experience adds value to investors providing them with undiscovered investment opportunities and multiple exit strategies. With over a decade of no principal losses, Manna Capital Group shows accredited investors how to aggressively reduce their tax liabilities while generating annual cash flow with large equity returns.

Adam W.

is a third-generation real estate developer with over 23 years of experience in land development and construction. He has led numerous single-family and multifamily projects overseeing planning, design, and construction operations. Adam is recognized for his strong background in real estate development strategy, market analysis, and team leadership within the construction industry.

“ M A N N A “

‘ANY SUDDEN OR UNEXPECTED HELP, ADVANTAGE OR AID TO SUCCESS’

All offers and sales of securities by Manna Capital Group are made exclusively to Accredited Investors. For individuals, this typically includes those meeting specific minimum annual income or net worth criteria or holding certain SEC-approved certifications. Securities are offered under exemptions from the registration requirements of the Securities Act of 1933, primarily Rule 506C of Regulation D and/or Section 4(a)(2) of the Act. As such, these securities are not subject to the same disclosure requirements as those under registration.

The SEC has not reviewed or approved the merits of, or given its endorsement to, any securities offered by Manna Capital Group, nor has it reviewed the terms of the offering or the accuracy and completeness of any offering materials. Securities offered by Manna Capital Group are subject to legal restrictions on transfer and resale; investors should not assume they will be able to resell these securities.

Investing in securities involves risks, including the potential loss of the investment. Securities offered by Manna Capital Group are not covered by the Investment Company Act protections.

Performance data provided by Manna Capital Group reflects past performance, which does not guarantee future results. Manna Capital Group and its funds are not legally required to follow standardized methodologies in calculating and presenting performance data, and the performance of these funds may not be directly comparable to that of other private or registered funds.